If you’re looking for the best home budget workbooks, I recommend exploring options like the Clever Fox Expense Tracker, PLANBERRY Budget Planner, and Adams Home Office Budget Book. These tools offer durable materials, customizable layouts, and organized sections for tracking income, expenses, and savings. Whether you prefer undated formats or stylish covers, there’s something for every budgeting style. Keep going to discover more detailed features that can help you stay on top of your finances.

Key Takeaways

- The top workbooks offer undated, flexible formats suitable for ongoing use and multiple-year budgeting.

- Many feature high-quality, durable materials like eco-leather covers and bleed-proof pages for long-term durability.

- They include comprehensive sections for income, expenses, savings, debt, and goal tracking to promote effective money management.

- Organizational tools such as pockets, stickers, tabs, and zipper pouches enhance usability and customization.

- Stylish, portable designs in various sizes and layouts cater to different user preferences and budgeting needs.

Clever Fox Income & Expense Tracker – Accounting & Bookkeeping Ledger Book for Small Business – 1-Year Record Notebook, A5 (Dark Green)

PERFECT LEDGER BOOK FOR SMALL BUSINESSES: This accounting ledger book for small businesses will help you organize finances,...

As an affiliate, we earn on qualifying purchases.

Clever Fox Income & Expense Tracker Notebook

If you’re a small business owner looking for a practical, easy-to-use bookkeeping tool, the Clever Fox Income & Expense Tracker Notebook is an excellent choice. Its undated design covers a full year, with 113 pages that include weekly views, an annual summary, and note pages, making organization simple. The compact A5 size fits easily into a bag, and features like the eco-leather cover, thick bleed-proof paper, elastic band, and pen loop boost durability and convenience. The squared layout keeps entries tidy, helping you track income, expenses, and balances effortlessly. Customers love its quality, practicality, and stylish look for managing their finances with confidence.

Best For: Small business owners seeking an organized, durable, and easy-to-use physical bookkeeping tool to manage finances throughout the year.

Pros:

- Undated design allows flexible starting and ongoing use without specific time constraints

- High-quality materials like eco-leather cover and bleed-proof paper ensure durability and a professional look

- Compact A5 size makes it portable and convenient for on-the-go financial tracking

Cons:

- No digital integration; requires manual entry and updating which may be time-consuming for some users

- Fixed layout might not suit all types of financial tracking preferences or more complex accounting needs

- Limited to one year of use; additional notebooks needed for multi-year financial management

PLANBERRY Large Budget Planner & Monthly Bill Organizer with Pockets – Budgeting Book, Finance & Expense Tracker, 8.3x9.4″ (Green Pastures)

ORGANIZE YOUR FINANCES & HIT YOUR MONEY GOALS: PLANBERRY Budget Planner & Bill Organizer is an effective, easy-to-use...

As an affiliate, we earn on qualifying purchases.

PLANBERRY Large Budget Planner & Monthly Bill Organizer

Looking for a stylish, durable planner that makes managing your finances straightforward? The PLANBERRY Large Budget Planner & Monthly Bill Organizer is perfect. Its high-quality faux leather cover, rose gold details, and thick bleed-resistant paper give it a luxurious feel. The undated pages and 12 laminated bill pockets offer flexibility and organization, while sections for budgeting, goal setting, and tracking income, savings, expenses, and debt keep everything clear. The spiral binding allows easy page turning and laying flat, making it user-friendly. With its sturdy design and thoughtful features, it’s an excellent tool for staying on top of your financial goals year after year.

Best For: individuals seeking a stylish, durable, and comprehensive budgeting planner to simplify their financial management and goal setting throughout the year.

Pros:

- Luxurious high-quality faux leather cover with rose gold detailing enhances aesthetic appeal and durability

- Flexible undated pages and laminated bill pockets provide adaptability for any start time and long-lasting organization

- User-friendly layout with sections for budgeting, goal setting, and tracking income, expenses, savings, and debt

Cons:

- Some users may desire additional pages for detailed savings and debt tracking to accommodate more comprehensive financial goals

- The size (8.3×9.4 inches) may be bulky for those preferring compact planners for on-the-go use

- Limited color options and text differentiation could make some sections less readable for users who prefer color-coded organization

Adams Home Office Budget Book, Weekly/Monthly Format, 10 x 7 Inches, White (AFR31),ABFAFR31

Detailed forms for weekly and monthly tracking help you stay accountable for personal spending

As an affiliate, we earn on qualifying purchases.

Adams Home Office Budget Book (AFR31)

The Adams Home Office Budget Book (AFR31) stands out as an ideal choice for small business owners and home office users seeking a straightforward, organized way to track their finances. Its large 10 x 7-inch size with a spill-resistant spiral binding makes it durable and easy to handle. The detailed double-page spreads, featuring 34 columns and 33 lines, allow for precise weekly and monthly tracking. Designed with eye-friendly blue and yellow print, it’s simple to read and use. With annual summaries and dedicated sections for taxes, investments, and health expenses, this book offers all-encompassing financial management in a user-friendly format.

Best For: small business owners and home office users seeking an organized, straightforward way to track their finances with a durable, easy-to-use physical budget book.

Pros:

- Large 10 x 7-inch format with detailed double-page spreads for thorough tracking

- Durable spiral binding that lies flat and resists spills

- Includes comprehensive sections for taxes, investments, and health expenses

Cons:

- Printed categories may require customization for specific financial situations

- Lacks digital integration or advanced financial features

- Some users find the fixed format less adaptable for unique or complex expense categories

Home Budget Workbook (with removable cover band)

As an affiliate, we earn on qualifying purchases.

Home Budget Workbook (with removable cover band)

The Home Budget Workbook with a removable cover band is an excellent choice for individuals who want a portable, straightforward tool to manage their finances. I’ve found it simple yet thorough, making it easy to track expenses, bill due dates, and monitor net worth. Its compact size and durable plastic cover make it perfect for on-the-go use. While the prefilled categories work well for many, I wish it offered more customization options, such as blank pages or labels. The metal binding ensures long-lasting durability, and the net worth page adds valuable insight. Overall, it’s an effective, user-friendly workbook that helps me stay organized and in control of my budget.

Best For: individuals seeking a portable, straightforward, and effective tool to manage their household or personal finances with ease and clarity.

Pros:

- Simple, thorough design that makes tracking expenses and net worth straightforward

- Compact size with durable plastic cover, ideal for on-the-go use

- Includes valuable features like detailed bill due date tracking and net worth comparison pages

Cons:

- Limited customization options; prefilled categories may not suit everyone’s needs

- Some pages are printed upside down, which can hinder usability

- The cover material could benefit from being stiffer to improve writing stability

Common Cents Budget Workbook

Are you new to budgeting and feeling overwhelmed by where to start? The Common Cents Budget Workbook is perfect for beginners, especially young adults, teens, and recent grads. It offers simple, practical forms for monthly budgets, savings, and debt tracking, making financial planning less intimidating. The workbook focuses on core principles like building emergency funds and avoiding debt, with easy-to-understand advice and motivating tips. Its visual appeal and straightforward approach help you stay consistent and gain confidence in managing your money. If you’re looking for a practical starting point to take control of your finances, this workbook is an excellent choice.

Best For: beginners, young adults, teens, and recent grads seeking an approachable and practical way to start managing their finances.

Pros:

- Simple, easy-to-understand forms and advice make budgeting accessible for beginners

- Visually appealing design helps maintain motivation and consistency

- Focuses on essential financial principles like emergency funds and avoiding debt

Cons:

- Lacks in-depth coverage of complex financial topics such as bankruptcy or college savings

- Not suitable for those needing advanced financial strategies or dealing with significant financial challenges

- Provides a basic overview without detailed guidance on dealing with creditors or foreclosure

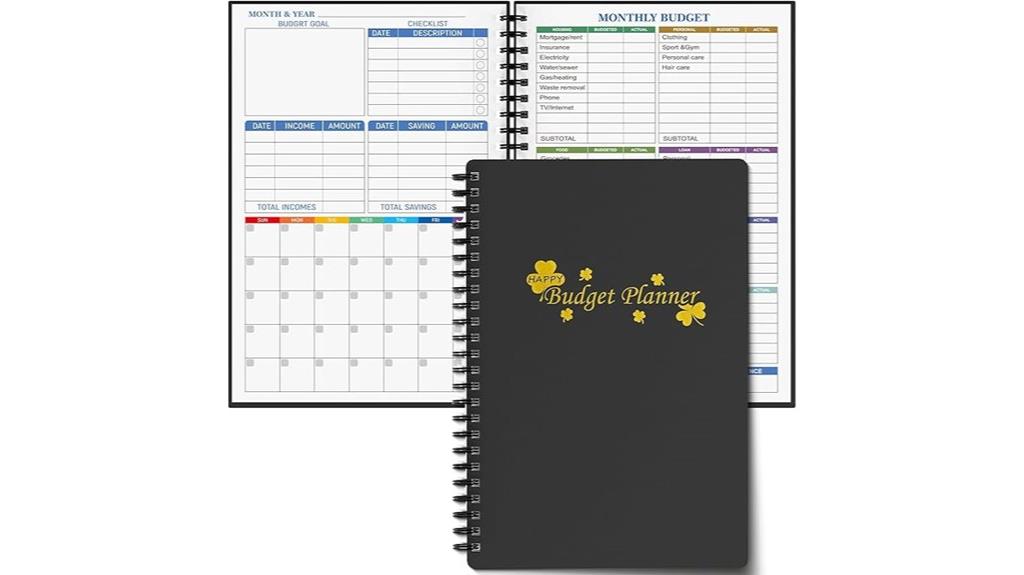

Budget Planner: Monthly Finance Organizer and Expense Tracker Notebook

If you’re looking for a straightforward way to stay on top of your finances, the Budget Planner’s undated format makes it perfect for anyone with a busy or unpredictable schedule. Its compact, A5 size fits easily into bags, making it great for on-the-go tracking. The sturdy cover and durable pages prevent ink bleed and damage, while the metal lay-flat binding guarantees longevity. With sections for goals, expenses, debts, and bill reminders, it offers a simple, user-friendly layout. Whether you’re starting fresh or adjusting your budget mid-month, this planner helps you monitor cash flow, set priorities, and stay accountable without feeling overwhelmed.

Best For: individuals with busy or unpredictable schedules seeking a simple, effective, and portable tool to manage their finances and stay accountable.

Pros:

- Undated format allows flexible start anytime during the month

- High-quality, durable pages and water-resistant cover prevent ink bleed and damage

- Compact A5 size with lay-flat binding for easy portability and long-term use

Cons:

- Limited color options and minimal decorative elements may not appeal to those wanting customization

- Slightly larger size could be less convenient for pocket carry

- Basic layout might lack advanced features or detailed calendar views for some users

Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook

Those looking for a flexible and easy-to-use financial planning tool will find the Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook ideal, especially since it’s undated and designed for one-year use. Its compact A5 size and durable rose-colored cover make it portable and sturdy. The planner features structured pages for setting goals, tracking savings and debts, budgeting monthly expenses, and reviewing progress. With color-coded months and sections for holiday budgets and yearly summaries, it keeps my finances organized. The high-quality paper reduces ink bleed, and the lay-flat binding makes writing comfortable. It’s a practical tool to help me stay on top of my financial goals all year.

Best For: individuals seeking a flexible, portable, and easy-to-use financial planner to manage their personal budget and expenses throughout the year.

Pros:

- Undated format allows for flexible start dates and customization across the year

- Durable construction with high-quality paper and sturdy cover for long-term use

- Color-coded monthly sections and comprehensive pages for goals, tracking, and reviews

Cons:

- Some users may wish for additional features like built-in pen holders or more storage pockets

- Limited to one year of use, requiring a new planner for ongoing financial management

- A5 size, while portable, may be too small for those who prefer larger writing spaces

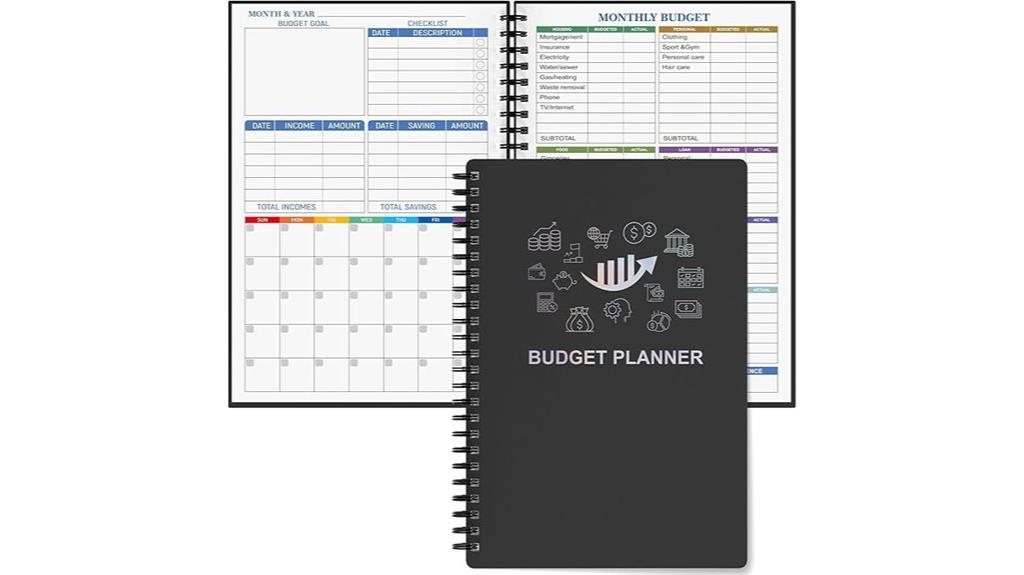

Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook

The Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook is an excellent choice for individuals seeking a flexible and all-encompassing tool to manage their finances. It features sections for setting financial goals, tracking expenses, reviewing monthly progress, and managing bills. Its undated format lets you start anytime, making it versatile for various needs. Made with high-quality, durable materials like thick paper and a sturdy cover, it’s built to last. The compact size fits easily into bags, and the metal binding ensures longevity. Users appreciate its clear layout and practicality, making it a reliable companion for achieving financial stability.

Best For: individuals of all ages seeking a versatile, durable, and easy-to-use tool for managing personal finances and building financial habits.

Pros:

- Undated format allows flexible start anytime, fitting various budgeting schedules

- High-quality materials like thick paper and sturdy cover ensure durability and longevity

- Practical layout with sections for goals, expenses, reviews, and notes enhances organization

Cons:

- Lacks an integrated receipt pocket for easier receipt management

- Does not include an annual overview page for long-term financial planning

- Slightly limited in size for those needing extensive note space or detailed tracking

Weekly Budget Planner: A Year-Long Undated Spending Tracker

The Weekly Budget Planner stands out as an ideal tool for individuals who prefer flexible, undated budgets that can adapt to their changing financial circumstances. I appreciate its year-long, undated format, which allows me to start anytime without wasting pages. The front includes a calendar for bills and important dates, while the inside cover offers space for project start and end dates. With sections for monthly income, expenses, savings goals, and weekly tracking, it keeps my finances organized. Its large size makes writing comfortable, and the attractive cover adds a personal touch. Overall, it’s a simple, affordable way to manage my budget throughout the year.

Best For: individuals seeking a flexible, undated budgeting planner that can adapt to fluctuating income and detailed expense tracking throughout the year.

Pros:

- Undated, allowing start at any time without waste of pages

- Large, spacious layout for detailed entries and comfortable writing

- Well-designed with attractive cover and customizable sections for personal needs

Cons:

- Some users find the layout unorganized, requiring flipping between sections

- Not spiral bound, which may affect ease of use for some

- Limited detailed structure, which might not suit those needing highly detailed budgeting tools

Soligt Budget Planner 2025, Monthly Budget Book

Are you looking for a flexible, portable budget planner that gives you full control over your finances? The Soligt Budget Planner 2025 is an undated, spiral-bound organizer designed for easy customization. Its compact size fits perfectly in your bag, and the durable hardcover keeps it protected. With 12 pockets, you can neatly store bills, receipts, and financial documents, while the colorful stickers and month tabs make navigation simple. The spacious pages allow detailed tracking of income, expenses, and savings. Customers love its stylish design, practicality, and how it helps them stay organized and motivated throughout the year.

Best For: individuals seeking a customizable, portable, and stylish budget planner to effectively manage personal finances and stay organized throughout the year.

Pros:

- Fully customizable blank, pre-filled pages for monthly, weekly, and annual budgeting

- Compact, lightweight design with durable hardcover and spiral binding for easy use on the go

- Multiple organizational features including 12 pockets, color-coded stickers, and month tabs for quick navigation

Cons:

- Limited space in calendar days may require additional pages for detailed tracking

- Some users desire more savings charts and expanded areas for goal setting

- Slight design quirks like upside-down cover words may affect initial presentation

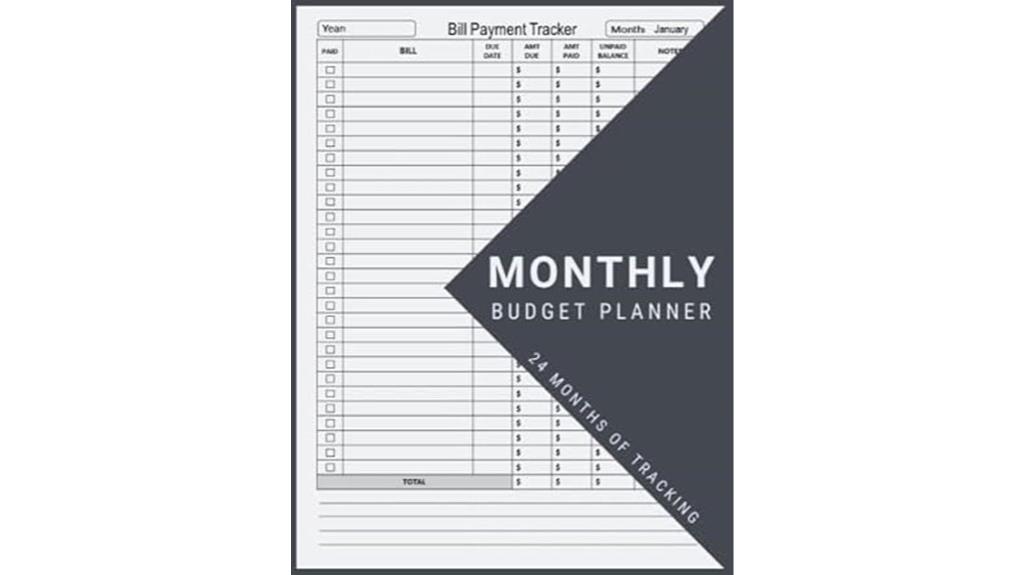

Monthly Budget Planner Workbook for 24 Months

If you’re looking for an all-encompassing tool to manage your finances over an extended period, the Monthly Budget Planner Workbook for 24 Months is an excellent choice. It helps you organize expenses, track bills, and monitor income versus expenses across two years. The planner features larger print and a user-friendly layout, making it easy to use even if you’re new to budgeting. Its well-formatted categories and clear breakdowns simplify financial management. With ample space for detailed entries, it’s perfect for managing multiple income sources or extensive finances. Users appreciate its clarity and exhaustive structure, which make long-term financial planning straightforward and stress-free.

Best For: individuals seeking a comprehensive, long-term financial organization tool to manage multiple income sources and extensive expenses over two years.

Pros:

- User-friendly layout with larger print for easy reading and writing

- Well-organized categories and clear expense breakdowns simplify tracking

- Ample space for detailed entries supports thorough financial management

Cons:

- Contains more pages than some users may need, potentially making it bulkier

- May require some time to familiarize with the extensive structure for new users

- Not specifically tailored for short-term or single-month budgeting needs

SOLIGT Large Budget Planner and Organizer with Pockets

With its large 8.5 x 11-inch size and ample space for detailed entries, the SOLIGT Large Budget Planner and Organizer with Pockets is perfect for anyone who wants to manage their finances thoroughly and comfortably. Its sturdy hardcover, thick 120gsm paper, and spiral binding guarantee durability and ease of use. The planner includes 12 pockets for receipts and documents, plus customizable categories and templates for tracking expenses, bills, debts, and savings. The chic boho cover and fun stickers add a personal touch. Overall, it’s a practical, stylish tool that makes detailed financial management simple, organized, and even enjoyable.

Best For: individuals or families seeking a large, durable, and customizable financial planner to thoroughly manage budgets, expenses, debts, and savings with ample space and organizational features.

Pros:

- Large 8.5 x 11-inch format provides plenty of space for detailed entries and tracking.

- Durable hardcover, thick 120gsm paper, and spiral binding ensure longevity and ease of use.

- Includes 12 pockets and fun stickers for organized storage and personalized planning.

Cons:

- The planner’s size may be cumbersome for carrying everywhere or fitting into smaller bags.

- Some users have noted missing accessories like stickers or manuals initially.

- The price point might be higher compared to smaller or less feature-rich planners.

Budgeting Workbook: Monthly & Weekly Expense Tracker and Planner

The Budgeting Workbook: Monthly & Weekly Expense Tracker and Planner is an ideal choice for beginners who want a simple, easy-to-use tool to manage their finances. Its floral cover and flexible pages make it visually appealing and durable. With 12 months, each spanning five weeks, it offers flexibility for any start date. The layout includes sections for monthly budgets, weekly expenses, and notes, covering bills, debts, and recurring costs like gas. While it requires manual entry due to no printed dates, this allows year-round use. Overall, it’s straightforward, practical, and helps users stay organized without overwhelming complexity.

Best For: Beginners and individuals seeking a straightforward, visually appealing budgeting tool to help organize and track their personal finances effectively.

Pros:

- Simple, easy-to-use layout suitable for those new to budgeting

- Durable, flexible pages with attractive floral cover for long-term use

- Supports comprehensive tracking of monthly budgets, weekly expenses, and notes

Cons:

- No printed dates, requiring manual entry which may be time-consuming

- Thin paper quality might affect durability over time

- Lacks a built-in folder or calendar for additional storage or quick reference

Ospelelf Budget Planner – Monthly Expense Tracker Notebook

The Ospelelf Budget Planner is ideal for anyone seeking an all-encompassing and flexible tool to manage their monthly finances. Its large 8.5 x 11-inch layout with premium thick paper offers plenty of space to track income, expenses, debts, and savings. With 12 undated monthly sections, it allows you to set goals, review progress, and develop solid financial habits. The durable spiral binding, hardcover, and organizational accessories—like pockets, stickers, and a zipper pouch—make it user-friendly and customizable. Whether you’re budgeting for everyday expenses or special occasions, this planner keeps your finances organized, motivating you to stay on track year-round.

Best For: individuals seeking a comprehensive, customizable tool to manage and track their monthly finances, including budgeting, saving, and debt management.

Pros:

- Large 8.5 x 11-inch layout provides ample space for detailed financial tracking and note-taking.

- Undated format allows flexible start times and year-round use without wasting pages.

- Includes organizational accessories like pockets, stickers, and a zipper pouch for easy document management.

Cons:

- The large size may be less portable for on-the-go use.

- Premium thick paper can be more expensive and may not be suitable for all pen types.

- Some users might find the extensive features overwhelming if they prefer simple budgeting tools.

Budget Planner with Monthly Tabs, Hardcover Journal and Budget Book

If you’re looking for a thorough and durable tool to manage your finances year-round, the Soomeet Budget Planner is an excellent choice. Its hardcover, large size (7 x 10 inches), and vegan leather cover make it sturdy and stylish. With monthly tabs, a 12-month structure, and extra layouts for annual summaries, it helps you stay organized. The planner includes dedicated pages for goals, expense tracking, and reflections, plus predefined categories to simplify budgeting. Features like an elastic band, pen holder, and back pocket keep everything secure and accessible. Rated 4.5 stars, users praise its clarity and quality, making it a reliable companion for effective money management.

Best For: individuals seeking a durable, comprehensive, and stylish budgeting tool to organize their personal and business finances throughout the year.

Pros:

- Features a hardcover vegan leather cover with a large 7 x 10 inch size for durability and ample writing space.

- Includes monthly tabs, 12-month structure, and additional layouts for annual summaries to keep finances well-organized.

- Equipped with dedicated pages for goals, expense tracking, reflections, and predefined categories to simplify budgeting process.

Cons:

- Some users have noted minor typos in the planner.

- Lacks built-in schedule tracking features that could enhance daily planning.

- The large size may be less portable for those preferring compact planners.

Factors to Consider When Choosing a Home Budget Workbook

When choosing a home budget workbook, I consider factors like how well it matches my budgeting style and how easy it is to carry around. I also look at the layout, organization, and how durable the materials are, so it suits my needs and lifestyle. finally, I check if it offers customization options to make budgeting more personalized and effective.

Budgeting Style Compatibility

Choosing a home budget workbook that matches your budgeting style is essential for maintaining consistency and motivation. I recommend selecting a layout that aligns with how often you want to track your finances, whether monthly, weekly, or daily, to keep your routine steady. Consider your comfort with complexity—simple forms work best for beginners, while detailed categories suit advanced users. Think about the format, like undated or customizable options, to fit your schedule and flexibility. The visual design should also support your motivation, whether through color coding or clear sections. Ultimately, ensure the structure matches your financial philosophy, such as envelope system or zero-based budgeting, so it integrates seamlessly into your habits and makes managing your money easier.

Size and Portability

Selecting the right size for your home budget workbook is essential for ensuring it fits seamlessly into your daily routine. A compact size, like A5 or smaller, makes it easy to carry in your bag, so you can update your budget anywhere. Larger formats, such as 8.5 x 11 inches, offer more space for detailed entries but can be bulky for on-the-go use. Lightweight materials and slim designs boost portability, helping you store it in a backpack without extra bulk. A spiral or flexible binding adds durability and allows the workbook to lay flat, making writing easier in tight spaces. Consider your daily habits—whether you prefer a small, discreet notebook or a larger planner with ample room for notes—to choose a size that suits your lifestyle perfectly.

Layout and Organization

A well-organized layout is essential for making your home budget workbook easy to use and effective. Clear sections for income, expenses, and savings help you record information accurately and avoid confusion. Organized categories and subcategories allow quick navigation and efficient tracking of different transactions. Consistent formatting, like tables or grids, makes data entry straightforward and helps you compare financial data over time. Dedicated spaces for notes, goals, and summaries support *all-encompassing* financial analysis and planning. An intuitive, logical arrangement reduces the learning curve, making the workbook accessible whether you’re a beginner or experienced. When choosing a workbook, look for a layout that promotes clarity, ease of use, and detailed tracking to stay motivated and manage your finances effectively.

Material Durability

To guarantee your home budget workbook lasts through frequent use, focusing on material durability is essential. Look for workbooks with thick polypropylene covers and sturdy spiral bindings, which can withstand regular handling. High-quality paper, ideally 100gsm or more, reduces ink bleed-through and prevents fraying, extending the workbook’s lifespan. Reinforced binding and heavy-duty covers protect pages from damage caused by handling or accidental spills. Water-resistant or spill-proof covers are a smart choice, safeguarding your data from everyday accidents. Additionally, sturdy pockets and reinforced edges help maintain structural integrity over time. Prioritizing durability ensures your workbook remains in good condition, allowing you to track your finances effectively without concerns about wear and tear.

Customization Options

When choosing a home budget workbook, it’s important to prioritize customization options that let you tailor the tool to your unique financial situation. Look for workbooks with blank or customizable categories, so you can add or remove expense types and align them with your goals. Editable pages or sections are essential, allowing you to reorganize categories as your finances change. Workbooks with blank labels or spaces for writing in personalized bills, income sources, or spending areas give you flexibility. Also, consider formats that offer undated pages or customizable headers, making it easier to adapt to different budgeting needs. Most importantly, ensure the workbook allows for easy re-organization or insertion of new categories without damaging pages, so your budget remains adaptable over time.

Price and Value

Choosing a home budget workbook involves more than just finding a format that suits your needs; it also requires considering whether the price reflects good value. I evaluate whether the workbook’s features, like comprehensive tracking pages, goal-setting sections, and organizational tools, justify the cost. Comparing prices, I look at durability, page quality, and any included accessories to guarantee I get the best value for my money. The design and layout are also vital—they should enhance usability and help me stay organized, making my financial management more effective. I also seek extras like pockets, stickers, or guides that add value without a hefty price increase. Finally, I consider customer reviews and ratings to confirm the workbook’s quality and functionality, affirming I invest wisely.

Additional Features

Have you considered how additional features can make your budgeting process more effective? Extras like net worth pages, expense trackers, and savings charts give you a clearer picture of your overall financial health. Storage options such as pockets or envelopes help keep receipts and bills organized and accessible. Personalization tools like stickers, tabs, or color-coding make exploring your workbook easier and more engaging. Built-in goal-setting sections and progress trackers keep you motivated and focused on your financial targets. Notes pages, reminders, and reflection prompts can deepen your understanding of your spending habits, encouraging better money management. These features not only enhance usability but also support long-term financial planning, making your budgeting experience more comprehensive and tailored to your needs.

Ease of Use

What makes a home budget workbook truly easy to use is its clear and straightforward layout that guides you through tracking income and expenses without confusion. I look for workbooks with pre-structured categories and minimal complex instructions, which simplify daily entries and reduce mistakes. Features like undated pages, prompts, and visual cues make updating and understanding your financial data more intuitive. Large, legible fonts and ample space for writing help prevent frustration and make daily use comfortable. A user-friendly design often includes helpful tips, examples, or summaries, especially useful for beginners. Overall, an easy-to-use workbook minimizes effort and confusion, making budgeting a more manageable and stress-free task. It’s all about simplicity and clarity to keep you motivated and consistent.

Frequently Asked Questions

How Do I Choose the Best Budget Workbook for My Financial Goals?

When choosing a budget workbook, I focus on my financial goals and preferences. I look for one that matches my budgeting style—whether it’s detailed tracking or simple overview. I consider features like expense categories, goal-setting tools, and flexibility. I also read reviews to guarantee it’s user-friendly and suits my lifestyle. Picking the right workbook helps me stay motivated and organized on my money management journey.

Can These Workbooks Help Improve My Long-Term Savings Habits?

Absolutely, these workbooks can help improve your long-term savings habits. I’ve found that they provide structure and accountability, making it easier to set realistic goals and track progress over time. By regularly updating and reviewing my budget, I stay motivated and focused on saving. They’re great tools for building consistency and developing healthy financial habits that last, ultimately helping you achieve your long-term financial dreams.

Are There Digital Alternatives to Physical Budget Planners?

Digital alternatives like budgeting apps and online spreadsheets are great options. I prefer apps because they sync with my bank accounts, making tracking expenses easier and more real-time. Plus, they often come with helpful features like alerts and goal-setting tools. If you like flexibility and instant updates, digital tools could be a perfect choice for managing your budget efficiently without the need for physical workbooks.

How Often Should I Update My Budget Workbook for Accuracy?

I recommend updating your budget workbook at least once a week to keep everything accurate. Life changes quickly, and your income or expenses might fluctuate, so regular updates help you stay on top of your finances. If you have a lot of financial activity, consider updating even more frequently. Staying consistent guarantees you catch issues early and make smarter money decisions. Trust me, it makes managing your money way easier!

Do These Workbooks Include Tips for Reducing Unnecessary Expenses?

Imagine trimming away the excess branches from a lush tree—these workbooks often include tips for reducing unnecessary expenses that help you clear out financial clutter. They guide you to identify and cut costs you might overlook, making your savings grow. I’ve found that most of these workbooks offer practical advice and strategies to help you stay on track and save more effortlessly.

Conclusion

Did you know that households using budget workbooks save an average of 20% more each year? Choosing the right one can truly transform your financial habits. Whether you prefer detailed tracking or simple planning, these workbooks make managing money less stressful and more effective. I encourage you to pick the one that fits your style—you’ll be surprised how quickly it becomes a powerful tool in reaching your savings goals.