To safeguard your financial interests, you should keep your loan agreement, interest rate documents, payment receipts, and correspondence with your lender. These records clarify your obligations, verify original terms, and help resolve disputes if they arise. Staying organized ensures you’re prepared for refinancing or negotiations and maintains legal protection. If you want to learn more about which documents are essential and how to manage them effectively, keep exploring these key details.

Key Takeaways

- Keep the original loan agreement, payment receipts, and bank statements to verify terms and payments.

- Save interest rate disclosures and notices to confirm applicable rates and changes.

- Retain correspondence with the lender for documentation of any amendments or communication.

- Preserve records of rate notices, disclosures, and related modifications for future reference.

- Organize all documents to ensure easy access for disputes, refinancing, or financial planning.

Have you ever wondered what documents are involved when securing a loan or financing? When you’re steering through the process, understanding which papers you need to keep is essential. These documents not only help you stay organized but also protect your interests throughout the loan term. One of the most important sets of documents relates to repayment terms and interest rates, as they define how you’ll pay back the loan and how much it will cost you over time. Keeping copies of these papers ensures you have a clear record of your obligations, helping you avoid surprises or misunderstandings down the line.

Keeping records of loan repayment terms and interest rates helps protect your financial interests.

When you sign a loan agreement, it spells out the repayment terms—how much you’re expected to pay each month, the duration of the loan, and any penalties for late payments. It’s important to keep this document safe because it’s your primary reference for understanding your responsibilities. If questions arise or disputes occur, having this agreement on hand allows you to verify what was originally agreed upon. Alongside the agreement, the documentation detailing interest rates is equally significant. Interest rates determine the total cost of your loan, influencing your monthly payments and the overall amount you’ll pay over the loan’s life. Whether the rate is fixed or variable, keeping the official notice or disclosure statement is necessary, especially if rates change or if you want to compare offers later.

In addition to the main loan agreement and interest rate documents, you should save all related correspondence with your lender. This includes emails, letters, or notices about changes in interest rates, payment schedules, or other terms. These records serve as proof of what was communicated and agreed upon, should any discrepancies arise. Also, retain all payment receipts or bank statements showing your payments. This documentation helps track your repayment history and can be useful if you need to dispute a missed payment or confirm your payment schedule.

Keeping these documents organized and accessible isn’t just about compliance; it’s about empowering yourself. If you ever refinance, renegotiate, or face financial difficulties, having thorough documentation makes the process smoother. It provides clarity on your original terms, especially the repayment schedule and interest rates, so you can make informed decisions. Additionally, understanding regional legal resources and local laws can influence your rights and options should issues arise in your area. Fundamentally, these documents serve as your financial blueprint, guiding you through the loan process and safeguarding your rights. By maintaining a detailed record, you’re better equipped to manage your loan responsibly and avoid potential pitfalls.

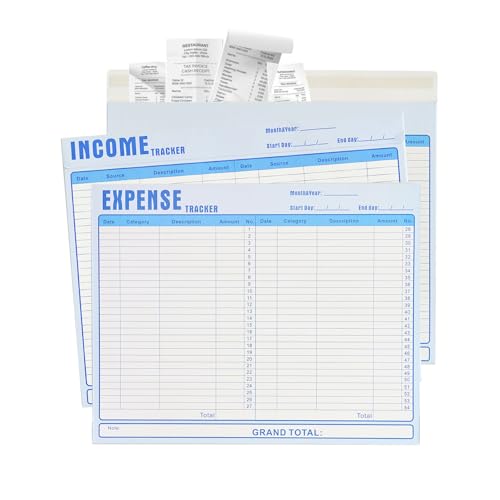

12/Pack Receipts Organizer Income & Expense Tracker Envelopes (11.4" W x 9" H heavyweight 110 lb. Cover cardstock), small business Organize keep Receipt holder for easier tax,Financial Plan envelope

【All In One Expense Organizer】:This is a handy way of keeping your monthly expenses organized in one place….

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Frequently Asked Questions

How Long Should I Retain Loan Documents After Repayment?

You should keep your loan documents, including repayment documentation, for at least seven years after repayment. This period supports loan document retention, helping you verify payments if needed and providing proof during tax or legal matters. Storing these records guarantees you’re prepared for any future questions about your loan history. Keep digital copies as a backup, and organize them for easy access in case you need to reference them later.

Are Digital Copies of Loan Documents Legally Binding?

Digital copies of loan documents are legally binding if they include valid digital signatures and follow electronic notarization standards. You should guarantee the digital documents meet federal and state laws, such as the ESIGN Act, which recognize electronic signatures as valid. Keep in mind that properly executed digital signatures and electronic notarization confirm authenticity and intent, making your digital loan documents just as enforceable as paper copies.

What Should I Do if I Lose My Loan Agreement?

Oh, losing your loan agreement? That’s the perfect excuse to ignore document security, right? Don’t panic—first, contact your lender immediately to request a loan retrieval and get a copy. Keep in mind, lenders often have digital or physical backups. To avoid future mishaps, store your documents securely and consider digital copies. Staying proactive guarantees you won’t need to relive this nightmare every time you need proof of your loan.

Can I Modify or Update My Existing Loan Documents?

Yes, you can modify or update your existing loan documents through a process called loan modification. Contact your lender to discuss your need for document updates or changes. They may require you to submit paperwork or financial information. Keep in mind, loan modifications can affect your interest rate or repayment terms. Always review the new documents carefully and keep copies for your records to confirm you understand the updated terms.

Who Is Responsible for Keeping Loan Records in a Business?

Think of your business’s loan records as the heartbeat of your finances; you’re the one responsible for keeping them steady. As the business owner or designated financial manager, you’re tasked with loan record management. Responsible parties must organize, store, and regularly update these documents to guarantee compliance and easy access during audits or refinancing. Your proactive approach keeps your financial health visible and well-maintained, securing your business’s future.

DANCING BEAR 25 Break Your Own Geodes, (Medium 1-1.5") 90% Hollow, Crack Open & Discover Amazing Surprise Crystals Inside! Educational Info and Instructions Included, Fun Party Favors & Prizes

✅ FUN GEODE SCIENCE KIT includes 25 break-your-own Moroccan geodes, educational information, and instructions sheet.

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Conclusion

Keep your loan and financing documents safe and organized. These papers are your proof and protection, guiding you through payments and potential disputes. Forgetting them risks losing essential details, facing unnecessary stress. While they may seem like just papers, they’re your financial safety net and peace of mind. Protect your future by holding onto these documents—they’re worth more than you think, serving as both memory and security in your financial journey.

Nicecho Receipt Coupon Organizer, 13 Pockets Small Accordion File Organizer with Labels for Receipt Cards, Bill Business, Coupons Storage, 10.2X 5.1 Inches

【HIGH CAPACITY】Product size is 10.2*5.1inch. 13 individual pockets, maximum 350 sheets of coupon. it is large enough to…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Sooez Accordion File Organizer, 13 Pockets Expanding File Folder, Portable Monthly Paper Bill Tax Receipt Organizer, Letter A4 Size Document Holder with Blank Labels, Black

All-In-One Monthly Organizer: Keep all your important documents in one place with Sooez Accordion File Organizer. 13 pockets…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.