To create a compliant document retention schedule, first categorize your documents by type, such as financial records, contracts, or employee files. Research legal and industry-specific requirements for each category to determine the proper retention periods. Implement digital archiving solutions for easy access and secure storage, and establish clear procedures for review and updates. Consistently enforce policies and train staff on compliance. Keep in mind, understanding best practices can further enhance your records management approach.

Key Takeaways

- Identify and categorize documents based on legal, regulatory, and industry-specific retention requirements.

- Research applicable laws to determine appropriate retention periods for each document type.

- Select secure digital archiving solutions that ensure accessibility, protection, and easy policy updates.

- Develop clear procedures for regular review, automated retention enforcement, and documentation of destruction actions.

- Train staff on retention policies and leverage automation to maintain consistent compliance and efficient records management.

Creating a document retention schedule is essential for guaranteeing your organization stays compliant with legal and regulatory requirements. When you develop a clear plan for how long to keep various types of documents, you reduce the risk of penalties, legal action, and data breaches. One key aspect of this process is understanding how digital archiving fits into your overall strategy. Digital archiving allows you to store documents electronically, making retrieval faster and more efficient. It also helps you manage large volumes of data while adhering to legal requirements that specify how long certain records must be retained. By integrating digital archiving into your retention schedule, you streamline compliance efforts and minimize physical storage needs.

Digital archiving streamlines compliance by enabling electronic storage, quick retrieval, and efficient data management.

To get started, you need to identify the types of documents your organization handles. These could include financial records, employee files, contracts, correspondence, or customer data. Once you’ve categorized your documents, you’ll need to research the specific legal requirements governing each type. Different industries and jurisdictions often have distinct mandates about how long records must be kept, and failing to comply can lead to fines or legal disputes. For example, tax records might need to be retained for seven years, while employee records have their own retention periods. Understanding these requirements ensures your retention schedule is both all-encompassing and compliant.

Next, you should consider the practical aspects of digital archiving. Selecting the right digital storage solutions—such as secure servers, cloud storage, or specialized document management systems—ensures your data remains accessible, protected, and compliant with relevant regulations. Digital archiving also facilitates easier updates to your retention schedule, allowing you to modify retention periods as laws evolve. Additionally, by digitizing records, you reduce the risk of physical damage, loss, or theft, which can jeopardize your compliance status. Incorporating digital archiving strategies helps ensure your organization maintains efficient and compliant records management over time.

Implementing a retention schedule isn’t just about creating policies; it’s about enforcing them consistently. You should establish procedures for regular reviews and updates, especially as legal requirements change. Automating retention policies through your digital archiving system can help flag documents that are due for destruction or review, ensuring you stay compliant without manual oversight. Training staff on these procedures is also critical, as human error often leads to non-compliance. When everyone understands the importance of adhering to the schedule and the role digital archiving plays, your organization moves closer to maintaining a compliant and efficient records management system.

Epson FastFoto FF-680W Wireless High-Speed Photo and Document Scanning System, Black

World’s Fastest Personal Photo Scanner (1) — scan thousands of photos as fast as 1 photo per second…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Frequently Asked Questions

How Often Should Retention Schedules Be Reviewed and Updated?

You should review and update your retention policy and schedule at least annually to guarantee compliance with changing regulations. Regular schedule reviews help identify outdated or unnecessary document retention periods, reducing risks and improving efficiency. Keep an eye on legal updates and industry standards, and adjust your schedule accordingly. By proactively managing your retention policy, you ensure that your organization stays compliant and maintains proper document handling practices over time.

What Tools or Software Assist in Creating Retention Schedules?

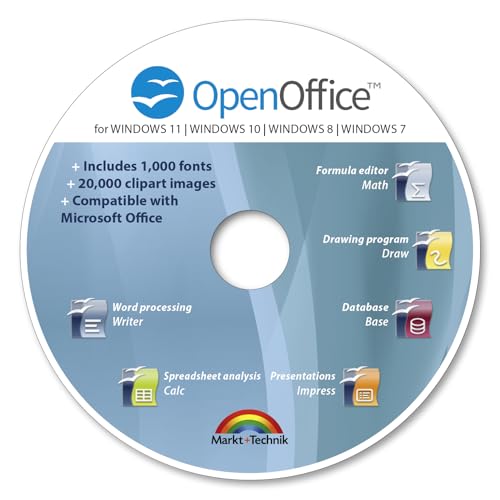

Think of your tools as the compass guiding your digital archiving journey. Software like Microsoft 365, OpenText, and Laserfiche help you craft retention schedules with ease. They feature automated classification, which sorts and tags documents instantly, making compliance straightforward. These tools streamline the process, reducing errors and saving time. By leveraging such software, you guarantee your retention schedule is always accurate, up-to-date, and aligned with regulatory requirements, keeping your organization on course.

How Do Retention Schedules Differ Across Industries?

You’ll find retention schedules vary across industries due to industry-specific regulations and data lifecycle management needs. For example, healthcare must follow HIPAA, requiring longer retention for patient records, while retail may prioritize shorter periods for transactional data. Understanding these differences helps you tailor retention policies effectively, ensuring compliance and optimizing data management. Adjusting schedules based on industry standards guarantees your organization stays within legal boundaries and maintains efficient data practices.

What Are the Penalties for Non-Compliance With Retention Policies?

Over 60% of companies face legal penalties for failing to comply with retention policies. If you ignore these rules, you risk hefty fines, legal actions, and damage to your reputation. Non-compliance can also threaten data security, exposing sensitive information. The legal implications are serious; you might be held accountable in court. Stay compliant by understanding your retention obligations, protecting data, and avoiding costly penalties.

How Can Organizations Ensure Employee Adherence to Retention Schedules?

You can guarantee employee adherence to retention schedules by providing regular employee training that emphasizes the importance of compliance. Reinforce policy enforcement through clear communication and consistent monitoring. Encourage questions and feedback to clarify expectations, and integrate retention policies into daily workflows. By fostering a culture of compliance and accountability, you make it easier for employees to follow retention schedules accurately and consistently.

Microsoft OneDrive 2025 for New Users: The Complete Beginner Guide To Cloud Storage Setup File Sync Security Privacy Collaboration Backup Recovery And Productivity Mastery For Everyday Users

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Conclusion

By crafting clear document retention schedules, you’re steering your organization like a captain guiding a ship through calm and stormy waters alike. With each policy in place, you guarantee compliance and protect your future, much like a lighthouse illuminating the way for sailors. Stay vigilant and keep your schedules current—because in the vast sea of regulations, your organization’s steady course depends on your careful navigation. Your diligence today secures your success tomorrow.

Office Suite 2025 Special Edition for Windows 11-10-8-7-Vista-XP | PC Software and 1.000 New Fonts | Alternative to Microsoft Office | Compatible with Word, Excel and PowerPoint

THE ALTERNATIVE: The Office Suite Package is the perfect alternative to MS Office. It offers you word processing…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

MY SOFTWARE – INVOICES

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.