Having proper insurance coverage documented is essential to guarantee you’re protected when unexpected events happen. It helps you quickly file claims by providing proof of your coverage and the details of your policy. Without clear documentation, you might face delays or denial of claims. Staying organized and keeping copies of your coverage details saves time and frustration. If you want to discover how to make sure your insurance is always properly documented, keep going to find out more.

Key Takeaways

- Insurance coverage documents confirm your policy details and what damages or losses are protected.

- Having proper documentation streamlines the claim process and ensures faster validation.

- It’s essential to understand your policy requirements to avoid claim delays or denials.

- Documenting your assets and coverage helps demonstrate damages and supports your claim.

- Reviewing and organizing your insurance documents regularly keeps you prepared in emergencies.

Understanding how the claim process works is equally important. When you experience a loss, theft, or damage, knowing the steps to file a claim can save you time and frustration. Typically, the claim process involves notifying your insurer promptly, providing proof of loss, and submitting any required documentation. You’ll want to confirm how quickly claims are processed and whether there are any specific conditions or documentation needed to validate your claim. Some policies may require detailed inventories or photographs to support your case. Familiarizing yourself with these procedures beforehand helps streamline the process and guarantees you don’t miss out on coverage when you need it most. Additionally, understanding the platform’s content discoverability features can help you find relevant information about your policy and how others have navigated similar situations.

Frequently Asked Questions

How Much Does Document Insurance Typically Cost?

Document insurance typically costs between $50 and $200 annually, depending on coverage details. You should do a cost comparison because premiums vary widely based on the provider and policy exclusions. Be sure to read the fine print, as some policies exclude certain document types or damages. Investing in insurance can be worthwhile if it protects valuable documents, but always weigh the cost against potential risks for peace of mind.

Are Digital Documents Covered Under Insurance Policies?

Your digital documents are often covered under insurance policies, but don’t assume they’re protected from everything—policy exclusions can leave gaps. Think of digital backups as your lifeline, yet some policies exclude certain digital files or data recovery costs. You need to check your policy carefully, because digital documents aren’t automatically covered. Without proper understanding, you risk losing irreplaceable information, feeling like your digital life is at the mercy of unpredictable policy limits.

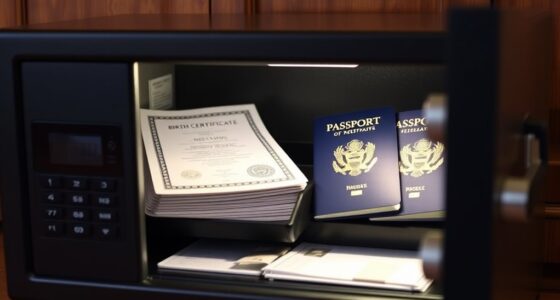

What Types of Documents Are Usually Insured?

You usually insure important documents like legal papers, financial records, and valuable digital files stored securely. When you consider document storage, make sure your policy covers digital formats and avoid insurance exclusions that might leave you unprotected. It’s crucial to verify what types of documents are insured, especially if they’re stored electronically, so you’re not caught off guard if a claim arises. Always read your policy carefully to understand coverage limits and exclusions.

How Do I File a Claim for Damaged Documents?

When your important legal documentation or digital backups get damaged, start by gathering all relevant proof of damage. Contact your insurer promptly, providing photos or descriptions of the affected documents. Fill out the claim form accurately, including details of the incident. Keep copies of communication, and follow your insurer’s instructions. Acting swiftly guarantees your valuable records are protected, and your claim process goes smoothly.

Can Coverage Be Extended to International Documents?

Yes, coverage can often be extended to international documents through international claims. You should check your policy details to see if it includes protection for documents outside your country. Extending coverage helps guarantee your documents’ validity remains protected globally, especially for critical papers like passports or legal contracts. Contact your insurer to confirm eligibility and understand any additional premiums or requirements for international coverage.

Conclusion

Think about a small business owner who thought their digital documents were safe—until a cyberattack wiped out their files. Without insurance, they faced hefty recovery costs and lost revenue. Don’t let this happen to you. Document insurance provides the safety net you need against unexpected disasters. Protect your valuable data now, so you’re not left scrambling when the worst happens. It’s a small investment for peace of mind and financial security.