As a freelancer or contractor, it’s essential to keep key documents like signed client contracts, detailed invoices, and accurate payment records to stay organized and protect your business. You also need proper tax documentation, including receipts and forms like 1099-NEC, along with clear project proposals and statements of work. Don’t forget to safeguard licenses and permits required for your industry. Keep these documents up-to-date to ensure smooth operations and compliance—more details await as you explore further.

Key Takeaways

- Signed contracts outlining project scope, deadlines, payment terms, and confidentiality clauses.

- Detailed invoices and payment records to track income and manage cash flow.

- Organized tax documents such as receipts, invoices, and relevant tax forms (e.g., 1099-NEC, Schedule C).

- Clear project proposals and statements of work defining deliverables, deadlines, and responsibilities.

- Valid business licenses and permits required to operate legally within specific industries or regions.

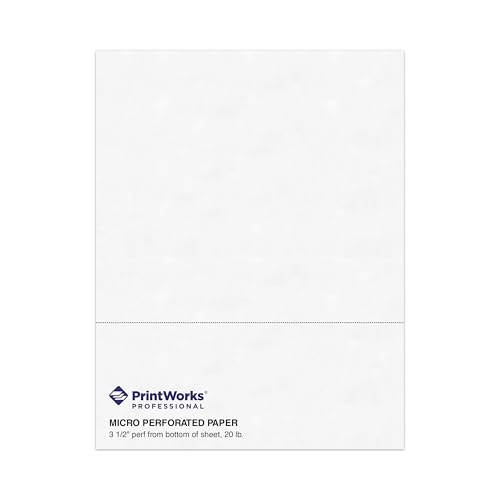

PrintWorks Professional 3 1/2" Horizontal Perforated Paper 8.5” x 11” – Perfect for W-2, 1099, & Statement Use – Made in The USA – 500 Sheets – 20 lb – Printer Compatible – White (04128)

Easily print W-2s, 1099s, statements, invoices, certificates, and coupons with this 3 1/2" perforated paper. These perforated sheets…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Client Contracts and Agreements

Have you ever wondered why solid client contracts are essential for your freelance or contractor work? They serve as your safety net, clearly defining project scope, deadlines, and payment terms. During contract negotiation, you can address important details upfront, ensuring both parties are aligned. Including confidentiality clauses protects sensitive information and maintains trust. These clauses prevent unauthorized sharing of proprietary data, giving you peace of mind. Well-crafted agreements minimize misunderstandings and disputes, establishing a professional foundation. They also specify intellectual property rights and termination conditions. By investing time in a thorough contract, you’re safeguarding your work and reputation. A 16PF assessment can help you better understand your personality traits, which may influence how you approach contract negotiations and client interactions. Remember, a clear, enforceable agreement isn’t just a formality; it’s a crucial tool for a successful freelance career.

Cossini Black Superior Vegan Leather Business Portfolio with Zipper – Padfolio All-in-One. Smartest Protective 10.1 Inch Tablet Sleeve, Presentation Slot, Solar Calculator, Card Storage, Writing Pad

Still superior, and now upgraded for life’s biggest advancements: Originally crafted to suit the advanced professional, we recently…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Invoices and Payment Records

Did you know that keeping detailed invoices and payment records is essential for managing your freelance income effectively? Proper invoice management helps you stay organized and guarantees you get paid on time. By tracking payments carefully, you can identify overdue invoices and follow up promptly, reducing cash flow issues. Maintain clear records of all invoices sent, received payments, and any adjustments or refunds. This practice aligns with best financial practices to ensure accurate accounting. This not only simplifies your financial overview but also prepares you for tax season. Using a reliable system for payment tracking minimizes errors and gives you a clear understanding of your income streams. Ultimately, good invoice management keeps your freelance business running smoothly and helps you maintain a professional reputation with clients.

Sooez 10 Pack File Folders, Clear Poly Envelopes Plastic Folders, Folder for Documents Letter A4 Size with Label Pocket, Teacher School Office Supplies Organization Storage, Assorted Color

Colorful Transparent Envelopes & Large Capacity: 5 assorted colors: transparent blue, green, yellow, purple, and pink (each color…

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Tax Documentation and Forms

Keeping accurate payment records makes it easier to gather the necessary documentation for your taxes. You’ll want to organize your receipts, invoices, and bank statements to support your income and expenses. Tax documentation includes forms like the 1099-NEC and Schedule C, which detail your earnings and allowable tax deductions. Proper financial statements help you track deductible expenses such as supplies, home office costs, and travel. Having these documents ready streamlines filing and ensures you maximize your deductions, reducing your taxable income. Regularly updating and reviewing your financial records also minimizes errors and audit risks. Additionally, understanding the Efficient General Ledger Coding can help you maintain consistent and accurate financial records. Remember, clear documentation isn’t just for filing; it provides a solid foundation to justify your deductions if questions arise later. Staying organized now saves you time and stress during tax season.

Landscaping Agreement Forms: Perfect For Preparing a professional Agreement For a Client or Company. 50 Forms | 8.5×11 Inch.

As an affiliate, we earn on qualifying purchases.

As an affiliate, we earn on qualifying purchases.

Project Proposals and Statements of Work

Are your project expectations clearly defined from the start? A solid project proposal and statement of work set the foundation. They should include precise scope definition, outlining what’s included and what’s not, to prevent misunderstandings. You’ll also want to include a detailed budget estimation, so both parties understand the financial scope upfront. This document acts as a roadmap, guiding the project’s progress and serving as a reference if disputes arise. Be clear about deadlines, deliverables, and responsibilities. By investing time in creating thorough proposals and statements of work, you’ll minimize surprises and ensure everyone is aligned. Additionally, understanding the zodiac signs’ compatibility can help foster better communication and collaboration with clients, especially when working across diverse backgrounds. These documents protect both your interests and your client’s, making the project smoother and more professional from start to finish.

Business Licenses and Permits

Have you secured the necessary business licenses and permits before starting your freelance or contracting work? Meeting the business license requirements is essential to operate legally and avoid fines. The process begins with understanding local, state, or federal regulations that apply to your industry. The permit application processes vary but generally involve submitting forms, paying fees, and providing proof of your qualifications or location. Some professions require specific permits, like health or safety certificates. Make sure to research thoroughly and keep copies of all approvals. Failing to obtain proper licenses can lead to penalties or even shutdowns. Staying compliant from the outset ensures your business runs smoothly and helps build trust with clients. Always verify current requirements to avoid surprises down the road. Additionally, maintaining proper documentation is crucial for demonstrating compliance during inspections or audits.

Insurance Policies and Legal Protections

Do you know how to protect yourself from financial risks and legal issues in your freelance or contracting work? Having the right insurance policies is essential. Liability coverage shields you from potential claims if someone is injured or if your work causes damage. It ensures you won’t have to pay out-of-pocket for costly legal expenses. Additionally, maintaining legal compliance by understanding industry-specific regulations helps prevent fines or lawsuits. Proper insurance demonstrates professionalism and commitment to safeguarding your clients and yourself. Review your policies regularly to ensure you’re covered for the scope of your work. Understanding divorce laws can also help you navigate legal challenges more effectively, especially when managing shared assets or responsibilities. By securing liability coverage and adhering to legal requirements, you create a solid foundation that minimizes risks and promotes trust with clients.

Frequently Asked Questions

How Should I Store Digital Copies of My Documents Securely?

You should store your digital documents securely by using reputable cloud storage services that offer robust security features. Make sure to enable encryption tools provided by these services to protect your files from unauthorized access. Regularly update your passwords and use two-factor authentication. Back up your files periodically on external drives or additional cloud accounts. This way, your important documents stay safe, accessible, and protected from potential breaches.

What Are the Best Methods for Tracking Project Milestones and Deadlines?

In project management, tracking milestones and deadlines keeps you on schedule. You should use digital tools like Trello, Asana, or Microsoft Project to organize tasks and set clear deadlines. Regularly update progress, set reminders, and review deadlines frequently. This helps you stay accountable and guarantees timely delivery. Using these methods, you’ll effectively manage your projects, meet deadlines, and maintain professional momentum.

How Often Should I Review and Update My Legal Documents?

You should review and update your legal documents at least once a year, or whenever there’s a significant change in your projects, contract renewal, or legal compliance requirements. Regular reviews help you stay current with laws and guarantee your agreements reflect your actual work. By doing this, you protect yourself and avoid potential legal issues, keeping your freelance business secure and compliant over time.

What Mandatory Documents Are Required in Different States or Countries?

Did you know that over 50% of freelancers face legal issues due to missing or incorrect documents? You need to stay aware of state-specific regulations and international compliance requirements, as these vary widely. Make sure your contracts, tax forms, and permits align with local laws in each state or country. Regularly check for updates to avoid penalties and guarantee your documentation remains valid and enforceable across different jurisdictions.

How Can I Protect My Intellectual Property Rights Legally?

To safeguard your intellectual property rights legally, you should register your work with the appropriate authorities, such as copyright offices or patent agencies. Use clear contracts to specify ownership and usage rights, and include confidentiality agreements when needed. Keep detailed records of your creations and communications. These steps ensure your intellectual property is legally protected, giving you stronger legal protection and making it easier to defend your rights if disputes arise.

Conclusion

Keeping these essential documents organized isn’t just smart—it’s a coincidence waiting to happen when you least expect a legal or financial surprise. By staying on top of contracts, invoices, tax forms, and licenses, you’re not only protecting your work but also creating opportunities you might never have anticipated. Think of it as setting the stage for success; the right documents could be the key to turning an unexpected challenge into a new opportunity.