If you’re looking to pay off debt faster, choosing the right planner can really make a difference. I recommend considering planners that are easy to use, durable, and visually motivating—think progress charts, payoff gauges, and customizable sections. Many great options include spiral-bound notebooks, expense trackers, and motivational tools to keep you on track. Keep in mind, the best planner suits your style and needs. If you want to explore options that fit your goals, you’ll find helpful tips ahead.

Key Takeaways

- Look for planners with visual progress trackers and payoff gauges to boost motivation and monitor debt reduction effectively.

- Choose planners offering customizable sections for debt info, repayment goals, and payment tracking to fit your financial situation.

- Prioritize durable, water-resistant materials and easy-to-use layouts for consistent, long-term debt management.

- Select planners with motivational features like stickers, reflection prompts, and milestone pages to stay engaged.

- Consider size and portability to ensure the planner suits your lifestyle, whether for on-the-go use or detailed monthly planning.

Debt Payoff Planner, 8.5×11 Inch, Spiral Bound, Monthly Expense Tracker, Financial Planner Notebook

If you’re looking for a straightforward and effective way to manage your debt, the Debt Payoff Planner, 8.5×11 inch, spiral bound, is an excellent choice. Designed with 110 pages, it offers detailed tables to track creditor info, payoff goals, balances, payments, and interest rates. Its user-friendly layout simplifies monitoring progress and setting clear repayment targets. The sturdy spiral binding lets pages lay flat, making writing easy whether at home or on the go. Made with high-quality materials, it’s durable and compatible with various pens. This planner helps you stay organized, motivated, and focused on reducing debt, ultimately guiding you toward financial freedom.

Best For: individuals seeking a simple, organized, and effective tool to manage and pay off debt, including students, professionals, and families.

Pros:

- User-friendly layout simplifies tracking creditor info, payments, and progress

- Durable spiral binding allows pages to lay flat for comfortable writing

- High-quality materials ensure longevity and compatibility with various pens

Cons:

- Cover design may be too conspicuous for those preferring discreet planning tools

- Limited to 110 pages, which may require additional planners for extensive debt management

- Not specifically tailored for digital integration or online tracking

Debt Snowball Tracker Notebook for Debt Payoff Motivation

The Debt Snowball Tracker Notebook is ideal for anyone who needs a visual and straightforward way to stay motivated while paying off debt. I found it incredibly helpful because it offers a clear visual of my progress, which kept me engaged and focused. Each page starts fresh, making it easy to track month after month without confusion. The payoff gauge on each page provides instant feedback, encouraging me to stay consistent. Users like me report that it keeps debt reduction manageable and boosts accountability. Overall, this tracker is a simple, effective tool that transforms the debt payoff journey into an achievable, motivating experience.

Best For: Individuals seeking a simple, visual, and motivating tool to help them stay on track with their debt payoff journey using the snowball method.

Pros:

- Provides a clear visual progress tracker to keep users engaged.

- Easy-to-use, with a consistent layout across pages for seamless tracking.

- Boosts motivation and accountability by giving instant feedback through payoff gauges.

Cons:

- May lack advanced features or customization options for detailed financial analysis.

- Limited multimedia or interactive content, which some users might prefer.

- Might require manual updating, which could be time-consuming for some users.

Budget Planner with Expense Tracker and Finance Organizer

The Budget Planner with Expense Tracker and Finance Organizer is ideal for anyone who wants a thorough, easy-to-use tool to manage their finances effectively. I love its compact, durable design with a water-resistant cover and elastic band, making it perfect for on-the-go use. It features full-page monthly calendars, customizable sections for income, expenses, and debt, plus bonus stickers and reflection questions that keep me motivated. The thick, ink-resistant pages prevent bleed-through, and the included guidebook offers helpful tips. Overall, this planner keeps my finances organized, helps me track my progress, and stays practical throughout the year.

Best For: individuals seeking a comprehensive, user-friendly financial planning tool to stay organized and motivated throughout the year.

Pros:

- Durable, water-resistant cover and thick ink-resistant pages ensure longevity and prevent bleed-through.

- Includes customizable sections, bonus stickers, and reflection prompts to enhance engagement.

- Compact design with ample space for notes and important dates, ideal for on-the-go use.

Cons:

- Elastic band may loosen over time, affecting the overall fit and security.

- Limited color options may not suit all aesthetic preferences.

- Some users might find the amount of features overwhelming if seeking a simpler budget tracker.

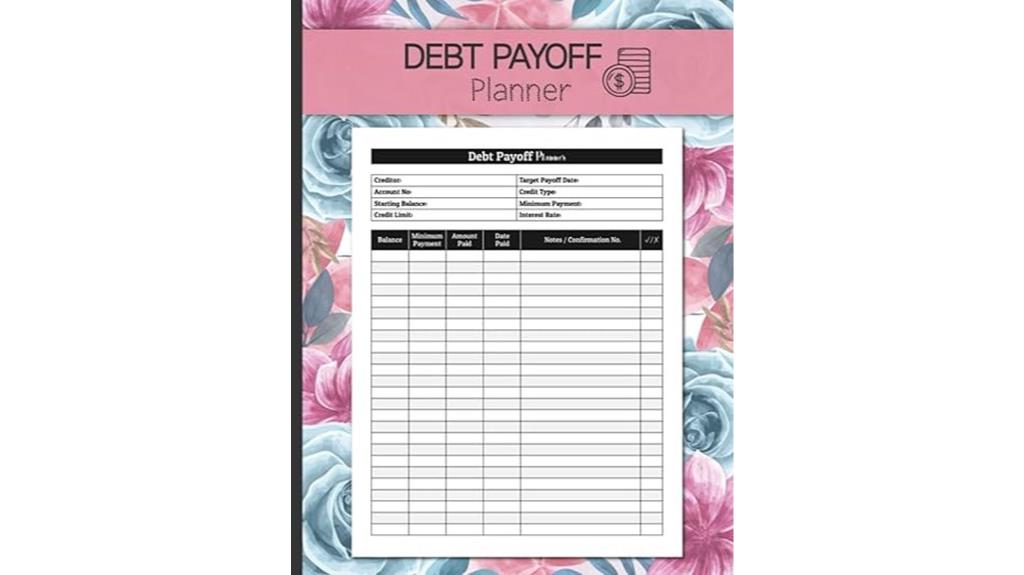

Debt Payoff Planner: Debt Tracker Log Book

A debt payoff planner, especially the Debt Tracker Log Book, stands out as the perfect choice for anyone seeking a straightforward way to monitor their debt reduction journey. It helps me track expenses, debts, and credit card balances clearly, making my financial picture easier to understand. The large spaces and simple layout make logging payments and progress effortless. Seeing my debt decrease over time keeps me motivated and accountable. Plus, the visual progress charts make it engaging and less overwhelming. Overall, this planner boosts my organization, helps me stay on top of bills, and supports steady debt reduction, making my path to financial freedom more manageable.

Best For: individuals seeking an easy-to-use, visually engaging tool to systematically track and reduce their debts while staying motivated and organized.

Pros:

- Simplifies debt tracking with large spaces and clear layouts for easy logging.

- Provides visual progress charts that motivate continued effort and accountability.

- Boosts organization and helps ensure timely bill payments and steady debt reduction.

Cons:

- May require consistent manual input, which some users might find time-consuming.

- Limited digital features; primarily a physical planner, so less accessible on the go.

- Might not include advanced financial analysis tools for complex debt management needs.

Debt Payoff Planner: Debt Tracker Organizer with 120 Pages

If you’re looking for a thorough way to stay organized while tackling large debts, the Debt Payoff Planner: Debt Tracker Organizer with 120 Pages is an excellent choice. It helps me track monthly bills, payments, and debt progress, including Klarna, Afterpay, and retail therapy expenses. The planner reminds me of due dates, promoting accountability, and keeps my financial info organized for tax season. With its extensive pages, it’s perfect for managing big debts. While the cover design isn’t very attractive and the pages feel more like schoolwork, I find it valuable for staying on top of my finances and maintaining focus.

Best For: individuals seeking a comprehensive and organized way to manage and pay off large debts despite a less attractive cover design.

Pros:

- Helps track monthly bills, payments, and debt progress effectively

- Keeps financial information organized for taxes and accountability

- Offers extensive pages, making it suitable for managing big debts

Cons:

- Cover design may be perceived as plain or misleading

- Pages are black and white, which some find unappealing

- Too bulky for portability and may resemble schoolwork, making it less suitable for use in public

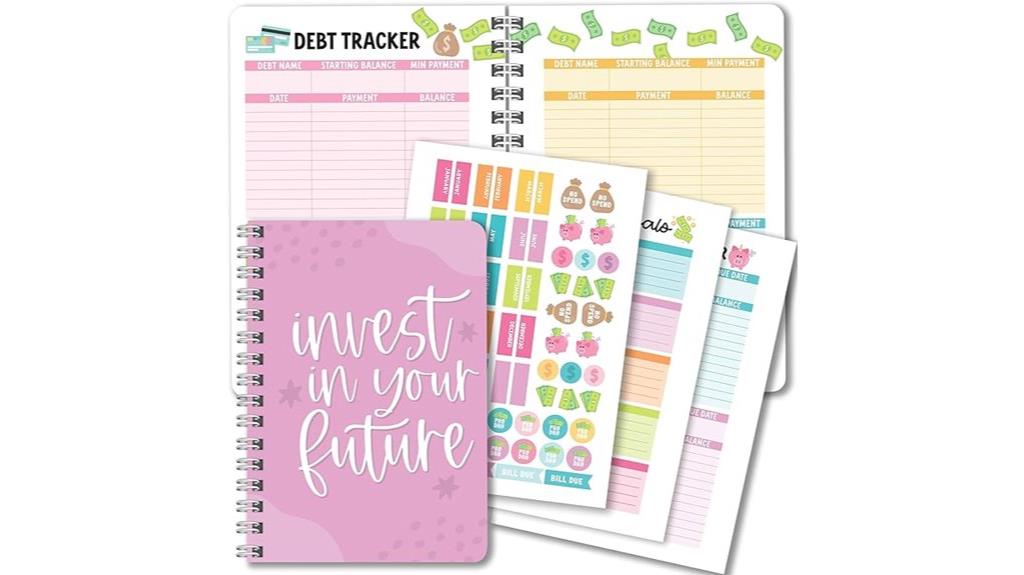

Hadley Designs Monthly Budget Planner 2025

For those who want a flexible and visually engaging way to manage their finances, Hadley Designs Monthly Budget Planner 2025 stands out as an ideal choice. This compact, undated planner combines style and functionality, making budgeting less overwhelming. It includes sections for tracking expenses, savings, bills, and debt, helping you stay organized. The colorful pages, stickers, and customizable categories keep you motivated and focused on your financial goals. Its well-designed layout is easy to use, supporting users in escaping paycheck-to-paycheck cycles and building lasting financial stability. If you value both practicality and aesthetics, this planner could be a game-changer for your money management journey.

Best For: individuals seeking a stylish, customizable, and comprehensive monthly budget planner that makes managing finances engaging and less overwhelming.

Pros:

- Well-organized layout that simplifies tracking expenses, savings, bills, and debt

- Colorful pages, stickers, and customizable categories boost motivation and personalization

- Compact, undated design offers flexibility to start anytime and tailor to your needs

Cons:

- May be slightly overwhelming for absolute beginners due to detailed tracking features

- No disc-bound or pre-punched options, which could limit customization ease

- Some users might find the colorful and sticker elements distracting or less professional for formal use

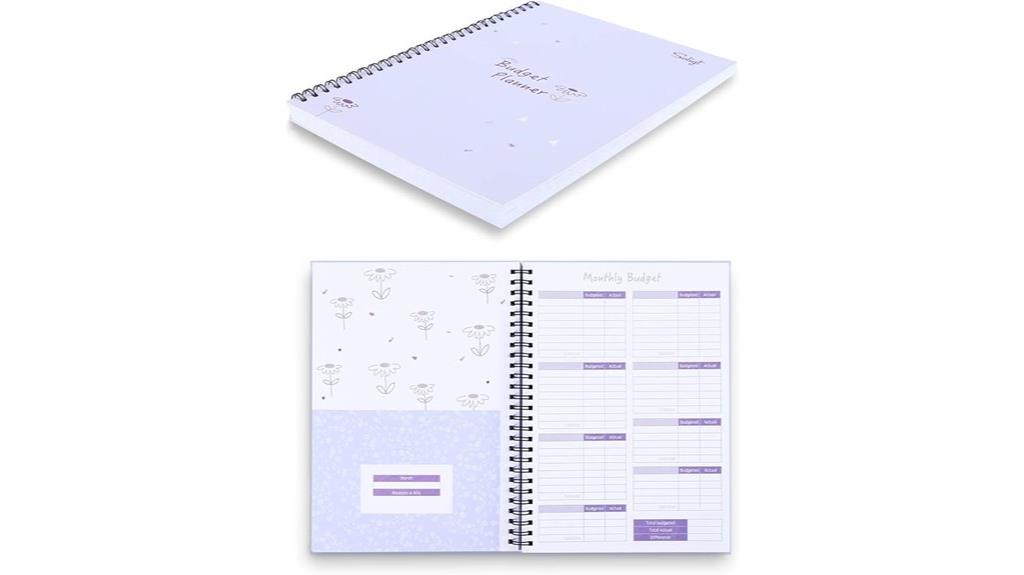

Monthly Budget Planner Book with 12 Pockets (Purple Spiral Design)

The Monthly Budget Planner Book with 12 Pockets (Purple Spiral Design) stands out for its customizable, undated pages, making it ideal for anyone who prefers a flexible, hands-on approach to managing their finances. Its durable hardcover and thick paper prevent bleed-through, while the compact size makes it portable. The 12 pockets help organize bills, receipts, and envelopes, with tab stickers for quick navigation. With blank pages, I can tailor categories and track detailed expenses, income, and savings. Bonus month tabs and stickers enhance organization, and the layout encourages consistent use. Overall, it’s a practical, customizable tool that keeps my finances clear and accessible throughout the year.

Best For: individuals seeking a customizable, portable, and durable manual budgeting tool that allows detailed expense tracking and organization throughout the year.

Pros:

- Durable hardcover and thick paper prevent ink bleed-through, ensuring longevity and clarity.

- 12 pockets and tab stickers facilitate easy organization of bills, receipts, and envelopes.

- Undated pages provide flexibility to customize months and categories as needed.

Cons:

- Pockets could be larger for easier access to bulkier receipts or documents.

- Limited dedicated note pages per month may require additional space for extensive notes.

- Some users might prefer more pre-defined categories to reduce setup time.

Monthly Bill Payment Checklist & Financial Planner Notebook

This Monthly Bill Payment Checklist & Financial Planner Notebook stands out as an ideal tool for anyone who wants to stay organized and motivated while managing their finances over the long term. It’s a detailed 4-year planner that helps track income, expenses, savings, and debt payoff. Its thorough bill management features include checklists for paid, auto-paid, and unpaid bills, along with due dates and amounts. The large, user-friendly layout makes daily tracking simple, while extra pages for notes and milestones keep you motivated. Whether you’re on a fixed income or teaching young people about money, this organizer consolidates all your financial goals in one accessible place.

Best For: individuals seeking a comprehensive, long-term financial organizer to manage bills, track progress, and stay motivated in their financial journey.

Pros:

- Combines detailed bill tracking, income, savings, and debt management in one organized notebook

- Large, easy-to-read layout facilitates daily use and long-term tracking over four years

- Includes extra pages for notes, brainstorming, and milestones, enhancing motivation and record-keeping

Cons:

- The 128-page format may require regular updates to cover four years for some users

- Larger size (8 x 10 inches) might be less portable for on-the-go use

- May be more detailed than necessary for those with simple or minimal financial tracking needs

SOLIGT 8.5 x 11 Inches Large Budget Planner with Monthly Bill Organizer

If you’re looking for a spacious, all-in-one planner to manage your debt payoff and monthly bills, the SOLIGT 8.5 x 11 Inches Large Budget Planner stands out as an excellent choice. Its large size provides ample space for tracking expenses, debts, bills, and savings, making it perfect for detailed financial management. The undated format allows flexible start dates, while the sturdy hardcover and thick paper guarantee durability. With 12 pockets for receipts, customizable categories, and fun stickers, it’s user-friendly and adaptable. Many users find it helps them stay organized and motivated, all in a stylish, giftable package that supports their financial goals.

Best For: individuals or families seeking a large, comprehensive, and customizable budget planner to effectively manage debts, bills, expenses, and savings with ample space and organization features.

Pros:

- Spacious 8.5 x 11-inch size with plenty of room for detailed tracking and notes

- Includes 12 pockets for receipts, bills, and documents, plus fun stickers for customization

- Durable hardcover with thick 120gsm paper, supporting frequent use and long-term organization

Cons:

- Larger size may be less portable and harder to carry around daily

- Some users initially experienced missing accessories like stickers or manuals

- Undated format requires manual date entry each month, which might be time-consuming for some

The Total Money Makeover Book

Designed for individuals enthusiastic to take control of their finances, the Total Money Makeover Book offers straightforward, practical strategies to eliminate debt and build savings. I found it incredibly motivating and easy to follow, with clear steps like creating a $1,000 emergency fund, snowballing debt payments, and avoiding reliance on credit. Ramsey emphasizes that success comes from commitment, discipline, and sacrifice, not quick wealth. The book’s relatable stories and simple advice help you understand responsible money management, stop living paycheck to paycheck, and develop long-term financial habits. It’s an empowering resource that can truly transform your approach to money and debt.

Best For: individuals ready to take control of their finances through disciplined debt repayment and savings strategies, especially those motivated to make long-term financial changes.

Pros:

- Clear, straightforward advice that is easy to understand and implement

- Motivational stories and practical steps that encourage disciplined financial habits

- Focuses on debt elimination and building emergency savings, fostering financial security

Cons:

- Limited detailed guidance on investment options like mutual funds

- Challenges in applying practical systems like envelope budgeting for some users

- Primarily US-centric, which may require adaptation for international audiences

Debt Payoff Planner & Payment Logbook

The Debt Payoff Planner & Payment Logbook stands out for anyone seeking a straightforward way to track and manage debt repayment without unnecessary complexity. I found it easy to use, with a clear layout and plenty of space to record payments and progress. Its simple design helps me stay organized and motivated, without feeling overwhelmed. Priced at just $4.99, it offers great value for its affordability and functionality. The logbook’s minimal effort required makes it ideal for anyone who wants to see their debt reduction clearly and stay on track. Overall, I highly recommend it for a practical, no-fuss approach to debt management.

Best For: individuals seeking an easy, affordable, and straightforward tool to organize and track their debt repayment progress without unnecessary complexity.

Pros:

- Simple and user-friendly layout that makes tracking effortless

- Ample space for recording payments and progress, ensuring comprehensive management

- Excellent value at $4.99, offering affordability and functionality

Cons:

- Limited customization options due to its minimalistic design

- May lack advanced features found in more comprehensive debt management software

- Not suitable for those who prefer digital or app-based tracking solutions

Debt Payoff Planner: Debt Payment Tracker and Organizer

The Debt Payoff Planner: Debt Payment Tracker and Organizer stands out as an ideal choice for anyone who wants a straightforward yet all-inclusive way to manage multiple debts. I find its simple, effective layout makes tracking payments, monitoring progress, and staying motivated easy. With over 100 pages, it allows me to record various accounts and see my overall financial situation clearly. Despite its ringlet style, which can be a bit inconvenient for folding and writing, it remains practical for organized debt management. Using this planner helps me stay focused, visualize progress, and stay motivated on my journey to debt freedom.

Best For: individuals seeking a simple, comprehensive tool to organize and track multiple debts and stay motivated on their path to debt freedom.

Pros:

- User-friendly layout that makes tracking payments and monitoring progress straightforward

- Over 100 pages provide ample space to record various accounts and details

- Helps maintain motivation and clarity throughout the debt repayment journey

Cons:

- Ringlet style binding can be inconvenient for folding and writing comfortably

- Not designed as a spiral binding, which may limit ease of use for some users

- Lacks digital integration, requiring manual entry and updates

Debt Payoff Planner: Debt Payoff Tracker

If you’re looking for a straightforward way to track your debt payments and stay focused on paying off high-interest debts, this debt payoff tracker is an excellent choice. Its simple, clean layout helps you easily list debts, monitor payments, and prioritize repayment strategies like the debt snowball method. Users love how it keeps things organized without unnecessary clutter, making debt management less overwhelming. While it could benefit from features like due date spaces, its effectiveness in helping people pay off debts faster is clear. If you want a no-fuss tool to stay on top of your progress, this tracker is highly recommended.

Best For: individuals seeking a simple, effective tool to track and manage their debt payments without unnecessary complexity.

Pros:

- Easy to use with a clean, minimalistic layout

- Helps prioritize debts and implement strategies like the debt snowball method

- Appreciated for its durability and effectiveness in speeding up debt payoff

Cons:

- Lacks dedicated spaces for due dates on each bill

- No blank pages included between entries for notes or additional info

- Pages are not in color, which could enhance visual appeal

Factors to Consider When Choosing a Debt Payoff Planner

When selecting a debt payoff planner, I consider how well it matches my specific debt types and how easy it is to use daily. I also look at its track record for durability and whether it offers extra features like budgeting tools. Ultimately, the right planner should be functional, visually appealing, and support my overall financial goals.

Compatibility With Debt Types

Choosing a debt payoff planner that works well with your specific debt types is essential for effective management. I look for planners that include dedicated sections for different debts like credit cards, student loans, or medical bills, so I can track each separately. Compatibility with various debt types helps me monitor payment progress and interest accumulation more accurately. I also prioritize planners with customizable fields to reflect different repayment terms and creditor details for each category. Supporting multiple accounts and recording starting balances, minimum payments, and interest rates is pivotal. When a planner aligns with my debt portfolio, I can better prioritize payments and develop effective strategies. This tailored approach makes managing and paying off my debts more straightforward and efficient.

Ease of Use Features

A debt payoff planner that’s easy to use can make managing your debts much less overwhelming. Look for a clear, straightforward layout that simplifies tracking payments and balances without confusion. Features like dedicated sections for due dates, payment confirmations, and notes help streamline your repayment process. Large, legible fonts and enough space between entries reduce clutter, making recording and reviewing information quick and effortless. Pre-designed templates or checklists guide you through consistent, organized steps, saving time and reducing errors. Visual aids such as progress bars or payoff gauges are also helpful, providing instant motivation and clarity on your repayment progress. An intuitive design ensures you stay engaged and on track, making debt repayment feel more manageable and less stressful.

Track Record and Durability

Ever wondered how long your debt payoff planner will last? Durability is key for a reliable tool. A well-made planner uses high-quality materials like thick paper and sturdy covers to handle daily use without falling apart. The binding type matters too—spiral or spiral-bound designs tend to lay flat and resist wear better than glued or stapled options. Checking a planner’s track record through customer reviews can give you insight into its long-term usability. A durable planner minimizes issues like torn pages, damaged covers, or loose binding, ensuring it stays functional throughout your debt repayment journey. Investing in a planner with proven durability saves you money in the long run, reducing the need for replacements and keeping your financial management steady.

Design and Aesthetics

When selecting a debt payoff planner, how it looks and feels can make a big difference in how often you’ll use it. A visually appealing design that matches your personal style or professional aesthetic can boost motivation and encourage regular use. An organized layout with clear headings, readable fonts, and thoughtful color schemes makes tracking progress easier and less stressful. Color coding, icons, and decorative elements help differentiate debts, payments, and goals, enhancing usability. Additionally, the cover material, binding style, and page design influence the planner’s durability and tactile experience, making it more enjoyable to handle. Choosing a planner that’s both attractive and functional increases the likelihood of consistent use, which is essential for effective debt management.

Additional Planning Functions

Choosing a debt payoff planner with additional functions can substantially boost your financial management efficiency. Features like expense tracking, bill management, and savings monitoring help you see the full picture of your finances, making it easier to stay on track. Incorporating goal setting, progress visualization, and motivational tools keeps you focused and accountable throughout your debt journey. Some planners include sections for tracking credit types, interest rates, and payment confirmations, providing exhaustive oversight. Multi-functional planners with customizable pages for budgeting, reflections, and milestone celebrations align your debt payoff with broader financial goals. By selecting a planner with integrated features beyond debt tracking, you streamline your organization, reduce the need for extra tools, and make your journey to debt freedom more manageable and efficient.

Frequently Asked Questions

How Do Debt Payoff Planners Improve Motivation and Accountability?

Debt payoff planners boost my motivation and accountability by providing clear, achievable goals and visual progress trackers. They keep me focused on my journey, reminding me of milestones and helping me stay committed. Knowing I have a structured plan and regular check-ins pushes me to stick to my payments, making debt reduction feel less overwhelming and more manageable. It’s like having a personal coach cheering me on every step of the way.

Can Debt Payoff Planners Accommodate Multiple Income Sources?

You’re wondering if debt payoff planners can handle multiple income sources. I’ve found that many planners are flexible and allow you to input various income streams, which helps create a more accurate repayment plan. By tracking each source separately, these tools give you a clearer picture of your overall financial situation. This way, I stay motivated and accountable, knowing every dollar from different sources is working toward my debt freedom.

Are Digital or Physical Planners More Effective for Debt Management?

When choosing between digital and physical planners, I find digital ones more effective because they’re flexible and easy to update on the go. I can sync them across devices, set reminders, and track progress instantly. Physical planners offer a tactile experience that some prefer for focus and visibility. Ultimately, I recommend picking what suits your style—digital for convenience or physical for a tangible, distraction-free approach.

How Often Should I Update My Debt Payoff Planner?

Think of your debt payoff planner as your road map—staying current keeps you on the right path. I recommend updating it at least once a month, especially when you make payments or receive extra income. Regular updates help you spot opportunities to accelerate your payoff plan and avoid surprises. Staying proactive guarantees you’re always steering in the right direction, making your journey toward debt freedom smoother and faster.

Do Debt Payoff Planners Include Strategies for Prioritizing Debts?

Yes, debt payoff planners often include strategies for prioritizing debts. I find that they help me decide whether to focus on paying off high-interest debts first or tackle smaller balances for quick wins. These planners guide me step-by-step, allowing me to customize my approach based on my financial situation. They’re invaluable tools that make the debt payoff process clearer and more manageable, helping me stay motivated and on track.

Conclusion

Choosing the right debt payoff planner is like finding the perfect map for a long journey. It guides you through twists and turns, keeping you focused on your destination—financial freedom. By selecting a planner that resonates with your style, you turn the intimidating maze of debt into a clear, manageable path. Remember, every small step you take with the right tools brings you closer to brighter, debt-free horizons.